To make retirement planning easier, USC is simplifying how Retirement Plan (403(b) plan) participants can make contributions to their plan using Workday. Beginning Jan. 1, 2026, your current matched up-to-5% contribution and the flat dollar supplemental contribution (i.e., your 403(b) contribution) will be combined into a single percentage contribution.

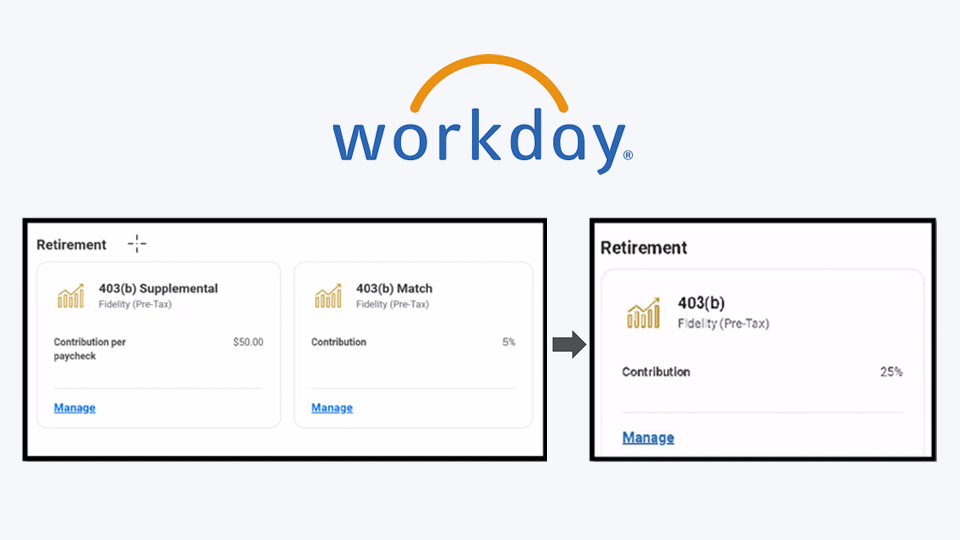

More details are contained in this message and an FAQ to support participants, as well as an image of what to expect in Workday, are shown below.

Note: This is a process change in Workday and does not in any way affect your retirement benefits; USC continues to match up to 5% of your contribution.

This is an event in Workday that will allow employees to update their 403(b) matched percentage contribution and flat dollar supplemental contribution (two tiles in Workday) to a single percentage contribution (one tile in Workday). Employees will receive a notification to do this, with instructions on how to do so, in their Workday inbox on Monday, Dec. 1, 2025.

This does not apply to 401(k) plan participants (hospital employees), whose contribution setup differs. There are no changes for these employees.

The event takes place from Dec. 1-12, 2025.

•On Dec. 1, employees will be asked to update their contributions within a Dec. 1-12 timeframe to allow USC to make the technical and retirement plan updates to a single percentage contribution.

•Between Dec. 13-31, any changes to retirement savings will not take effect if made in Workday and will instead be manually made by USC Retirement Administration, with employees directed to email Retirement to make the change during this timeframe.

•From Jan. 1 onwards, employees can make updates using the single tile in Workday.

USC has the following support available to assist employees in calculating their contribution amount:

•Step-by-step guide to changing your retirement contribution (single sign-on required, and refer to the Retirement section) outlining how to make or update contributions in Workday.

•A 403(b) Calculator to calculate your optimal retirement contributions. Refer to the 403(b) Calculator Guide for steps on how to use the calculator. Note: This a 401(k) Match Calculator but it can also be used to calculate your 403(b) contributions, given that both are retirement programs.

•TIAA webinars to assist employees who utilize TIAA as their vendor for changes specific to TIAA annuity contracts:

• Nov. 17, 2025: 12 p.m. – registration link

• Nov. 21, 2025: 1 p.m. – registration link

• Meetings can be scheduled with Retirement Administration using this booking link, where employees will be offered assistance in calculating their IRS maximum allowable contribution.

If employees do not make an election between Dec. 1-12, their match percentage contribution as of 6 a.m. PT on Nov. 15 will be the contribution withheld from their January 2026 pay.

If an employee does not wish to make an election or is not a participant in the 403(b) plan, no action is required. Note: Retirement regulations will permit USC to default an employee’s automatic 403(b) matched deferrals. Voluntary deferrals must be elected by the participant.

Yes. Retirement contribution changes can be made by employees at any time of the year.